Congratulations on deciding to start a business! It’s a brave step into the unknown, but don’t worry — you have plenty of company. Did you know that in July 2023 alone, there were nearly half a million new business applications in the U.S.?

The old saying goes, “If you fail to plan, you plan to fail.” Learning how to make a business plan can keep you on the right track, making intelligent business decisions based on real-world data.

Whether you’re writing a for-profit or nonprofit business plan, here’s what you need to know.

The importance of a well-crafted business plan for success

New businesses share the hope of growth and success, but not everyone makes it. According to the U.S. Bureau of Labor Statistics, around 20% of all new organizations close before the end of the first year. When you learn how to create a business plan, you give yourself an essential resource for success. Business plans help you pitch your idea to others — and set yourself up to thrive.

Why every business needs a solid business plan

Many entrepreneurs learn how to make a business plan when they apply for financing. A solid business plan shows lenders and investors that you’ve thought through your idea and know how to make it profitable. They can follow your strategy and ensure it’s solid before investing.

However, funding isn’t the only reason for writing a business plan—even the most independent self-funded business benefits from a written strategy for success.

Benefits of having a business plan, even without seeking financing

Starting a business without a plan is like driving to a new destination without directions. You might get where you’re going eventually, but you’ll probably get lost a few times first. If you think about your route before putting the car in gear, you’ll get there faster and with fewer wrong turns.

Learning how to make a business plan is like making a map. Business plans help you identify your long-term and short-term goals and develop a strategy for achieving them. Plus, because they’re written down, you can analyze them and get second opinions from experienced professionals.

How to create an effective business plan

Learning how to make a business plan can feel intimidating if you’ve never written one. Don’t panic — here’s a step-by-step strategy, starting with the business idea you’ve already begun to develop.

Define your business idea and objectives

Most businesses start as the germ of an idea. I love dogs, someone thinks to themselves. Maybe I’ll start a doggy daycare.

That simple thought is the seed of a business plan. The next step is to pull it into the light and look at it from multiple angles.

Challenge yourself to be as specific as possible. Ask questions like:

- What problem will I solve for my customers?

- Who will be interested and willing to pay?

- What other options are available to those customers, and how will this differ?

Next, identify your business objectives. Objectives are detailed goals that define what success looks like for you. For example:

- We will establish our first brick-and-mortar location by the end of the first year.

- We will create a budget that keeps income above expenses by our fourth month of business operations.

The more specific your objectives are, the more helpful they are as targets. They’ll serve as guideposts for the subsequent sections of your business plan.

Conduct market research and analyze your target audience

Your next step is to learn about your potential customer base and their need for your product or service. At this stage, you’re primarily looking for the possible interest level and whether it’s enough to sustain the business you’re planning.

Market research helps you understand your potential customers. The main issues to investigate are:

- Demographics of your target audience: age, gender, income level, etc.

- Unmet needs you could fill

- Questions your target audience typically asks

- How much they spend on your product or services

- What other companies they buy from, and what you can offer that’s different

You can find information on most of these topics online. Your competitors’ websites and social media pages offer helpful insights about what engages your customers. You can search for trade publications and market research reports in your industry if you’re up for more.

But don’t get overwhelmed — a sense of the basics is enough at this stage.

Craft a compelling executive summary

An executive summary is your business plan’s elevator pitch. It includes just enough to interest the reader and show them you have a viable strategy.

An effective executive summary for a small business plan is about two pages. It will include the following:

- Introduction: A description of the business and the market needs it will fulfill

- Marketing summary: Basic information about your target market, including customer demographics, leading competitors, and what makes your business stand out

- Operations and management summary: A brief introduction to your management team, including critical qualifications, and essential details about how the business will run

- Financial plan: Three years’ worth of income projections and a statement of how you will cover expenses, including an estimate of any funds you need

You’ll explore each of these topics more thoroughly in later sections. You may want to write those last three sections first to help you flesh out the details. You can use the finished sections as resources to write your summary.

Describe your company, its mission, and vision

Identifying the “why” of your business is a crucial step in learning how to write a business plan. There are two ways of articulating that “why.”

One is your company’s mission statement — a brief explanation of what you hope to achieve by starting or growing your business.

The other is your vision. A vision statement describes what it will look like when you realize your mission and reach your goals. In it, you paint a picture for the reader of what your successful business will look like.

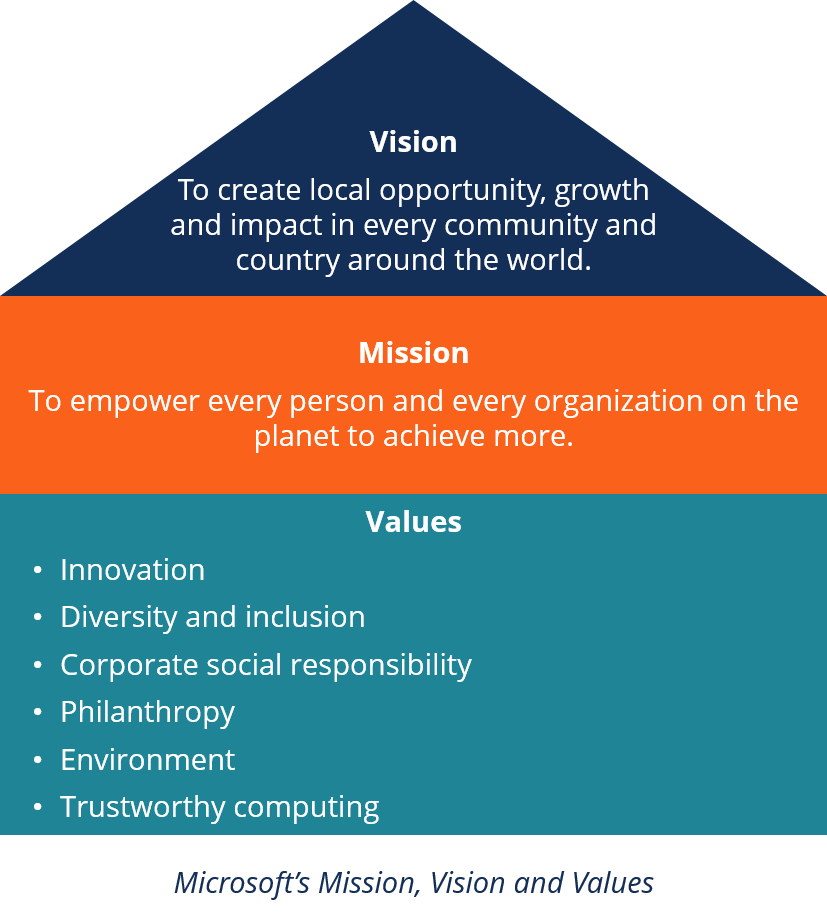

Many companies also include a list of core values along with their mission and vision statements. The values drive the mission, which powers the vision. Here’s what that looks like:

If you don’t have a mission statement, identify your core values. They’ll help you articulate your purpose and vision.

Analyze the industry and your competition

You started this step when you first began doing market research. Now, your goal is to offer more concrete information about opportunities and why you can meet market needs.

Don’t let the phrase “industry research” scare you. Plenty of free and low-cost data is available and accessible to laypeople.

Many consumer research firms publish industry-specific market reports. Free options give you an overview, and paid reports offer in-depth detail. Consider investing in a paid report if possible.

Industry associations and trade publications publish useful information, including consumer buying behavior and market trends. Some associations distribute local and state data, which is particularly useful in understanding direct competition.

Finally, consider doing a formal competitive analysis to learn how you compare to existing offerings. Look at three basic types of competition:

- Direct competition: Businesses that provide your target market with similar products or services.

- Indirect competition: Businesses with different offerings that could meet the same need.

- Replacement competition: Businesses with the potential to disrupt the market and change demand for your product. For example, Expedia disrupting the travel agency market.

You can find competitors by analyzing search results, exploring related pages on social media, and identifying brands your target audiences mention online. Once you’ve identified top competitors, explore their branding and unique selling propositions. Find out where they excel and where you can fill in gaps.

Outline your products and services and their unique selling points

After identifying what else is available to your customers, you can define your offerings in more detail and create a unique selling proposition (USP). A USP explains what your business does differently and better than the competition. It presents you as the obvious choice for your target market.

Start by looking at each product or service you plan to offer. Identify which competitors have similar offerings and what makes your version stand out. For example, suppose you have a landscaping business in a popular suburb. There might be dozens of landscapers in the area, but you’re the only one that uses all-organic fertilizers.

Next, develop a USP for your business as a whole. Articulate why customers would choose you over any other option, considering the unique aspects of your products, services, and customer care.

Create a solid sales and marketing strategy

Having unique products or services is essential, but your business will only succeed if people know about it. Creating a detailed strategy in your business plan will make your marketing smoother.

If you’ve done your market research and competitive analysis, you’re most of the way there. Now, you have to explain the marketing and sales approaches you plan to use. Aim to touch on each of the following:

- Planned marketing channels, such as email and social media

- Overall and per-channel marketing budgets

- Promotional strategies, including pricing plans

- Sales targets and timelines

- Audience-specific messaging and customer segments

The more specific you can be, the better. For example, instead of just listing email as a marketing strategy, specify how many subscribers you aim to have and what messages you plan to send.

Determine your financial needs and projections

Anyone reading your business plan will want to know how you intend to fund your early operations — mainly if you apply for funding. You’ll need to describe in detail how much money you need and how you’ll use it. Common startup costs for new businesses include:

- Office space and utilities

- Equipment and inventory

- Insurance

- Legal and accounting services

- Employee salaries

- Advertising costs

Determine the amount of each projected expense and add them up. Then, offer a sales forecast to show how you’ll recoup those expenses. It should include:

- A list of each product or service you’ll sell

- The number of orders or sales you expect

- The value of each order and the total value of sold items

- The cost of each sale, subtracted from gross income

- Potential adjustments, such as seasonal changes

Again, the more detail you include, the better. A detailed financial forecast helps you create a more informed strategy.

Plan your organizational structure and team

As you learn how to make a business plan, consider your leadership structure. Potential investors and business partners will want to know who’s at the helm, including each person’s responsibilities and qualifications.

Begin by naming your established or planned business structure. For example, you may be a partnership or sole proprietorship with plans to incorporate in a few years.

Next, list your leadership team members and each person’s job description, if applicable. Include executive and management roles you plan to fill soon.

Finally, create a description of several paragraphs to a page for key executive team members. Describe each person’s relevant qualifications and any accomplishments that reflect their ability to help the business succeed.

Include supporting documents in the appendix (if applicable)

A comprehensive business plan often has an appendix with additional detailed documentation. This section gives investors and other seriously interested readers the background information they need without overwhelming those who want more basic information.

Use the appendix like you’d use footnotes or end notes in a white paper or case study. Make your point in the main document, include vital data, and refer the reader to the appendix to learn more.

For example, suppose your industry is experiencing rapid market growth. You might mention percentages in the body text, then add the full report in the appendix for anyone who wants to fact-check.

Other common supporting documents in business plan indexes include:

- Resumes of owners or senior managers

- Product photos or descriptions

- Licenses and permits

- Patent or trademark documents

- Data visualizations, such as charts or graphs

Not every business plan will have an appendix. Include one if you have essential documents to attach but don’t feel the need to add extraneous content.

Key elements to include in your business plan

A traditional business plan can be in the ballpark of 30 pages, but small businesses often don’t need that much detail. Focus on these six sections to make a business plan shorter.

Executive summary

Executive summaries are so standard that the absence of one would be noticeable. This is the Cliff’s Notes version of your plan. Even if you think you’ve covered everything elsewhere, include an executive summary with a basic overview.

Be concise but engaging. Like the blurb on the back of a novel, your executive summary should entice readers to learn more.

Company description

Even the briefest business plan needs a basic rundown of the company’s purpose and activities — what it does, who it serves, and what market gaps it fills. Remember that your primary goal is to show your business’s unique potential.

Market analysis

This section of your business plan has two primary purposes. For supporters, such as funders and potential partners, it shows that your business meets a market need. It also serves as a reference as you develop your brand, product line, and business model.

The section should cover:

- The state of your industry, including projected growth if relevant

- A description of your ideal customers

- A roster of your main competitors, including their strengths and weaknesses

- Your unique selling proposal

Don’t include your sales strategies yet — you’ll touch on those when you discuss your marketing plan.

Organization and management

This section is essential if there’s more than one business owner. It clarifies each person’s responsibilities and background while establishing the leadership chain.

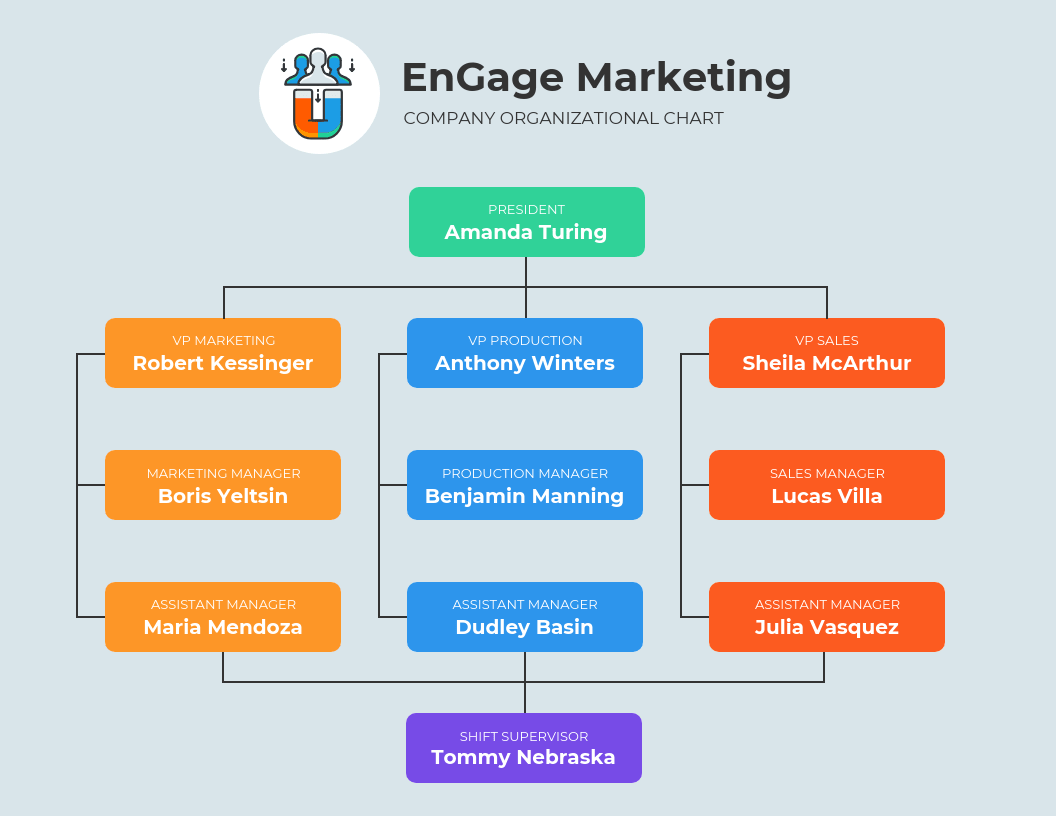

Many businesses use a flowchart to summarize leadership structure. Here’s one example by infographic development software Venngage:

Supporters outside your company will use this section to learn about your team’s industry expertise. It clears up any confusion about your business structure for you and future hires.

Of course, if you’re a solopreneur, all you’ll have is your bio. Feel free to go into detail about your professional history and why you’re the perfect person to launch this new venture.

Products and services

This section’s purpose is to show what’s special about your offerings, and to demonstrate why they’ll be successful. The sections should include the following:

- A description of each product or service

- An explanation of key features and why they set you apart

- The consumer benefits of those features

- Any awards, testimonials, or other social proof

Keep your language simple and stay away from jargon. You may need to show your business plan to people outside your industry.

Sales and marketing strategy

You put your market knowledge into action in the sales and marketing section. Start with marketing and the following components:

- Branding: The image you’ll present to the world and what you want it to convey.

- Pricing: The consumer cost of each product or service and how you came up with those numbers.

- Marketing channels: Where you’ll promote your product and why you chose each channel.

- Sales forecasts: How much revenue you expect to generate from your marketing campaigns.

For the “sales” component, you’ll cover the customer experience. Lead the reader through where sales will happen, how the product will get to the customer, and how returns will work.

Use your business plan as a roadmap for success

By this point, you have a basic grounding in how to make a business plan. You’ve learned why each section is important and how to find the information you need to write it. Most importantly, you understand how writing a successful business plan can guide your growth.

As you write your plan, think about where you want it to take you. Imagine you’re at a networking event a few years down the road and telling someone what kind of company you own. Describe what you want the company to do for its customers and how you want to grow.

You can use that “future-you” technique for each section. You won’t do it all in one day, so bookmark this article so you can return to it. And enjoy — it’s time to let your dreams take shape.

Once you’ve got your business in order, it’s time to focus on spreading the word to potential customers. Constant Contact is a full-scale digital marketing platform that helps SMBs reach their audience through email, social media, events, landing pages, and paid advertising. Start your free trial today.