Whether you’re new to the insurance industry or have been at it for decades, in order to keep your business growing, you need to understand insurance marketing almost as well as you understand insurance.

Insurance marketing starts with an in-depth understanding of the kinds of customers you want to write policies for. You may be tempted to think you want everyone to come to you with their business, but in reality, your services are likely designed for specific types of clients.

For a successful marketing campaign, spend time determining what group of people you want to reach. Perhaps you are looking to attract more retirees or young families. You may prefer entrepreneurs or even recent college graduates. The more you can describe the demographics, problems, needs, and lifestyle decisions of your prospects, the easier it will be to reach them through your marketing efforts.

With a specific audience in mind, you can try these marketing must-haves:

- Email marketing

- Referral program

- SEO-friendly website

- Online reputation management

- Paid digital ads

- Social media outreach

Let’s take a closer look at each of these strategies when marketing for your insurance agency.

Find more leads and drive policy renewals with expert marketing advice and all the tools you need, all in one place.

1. Email marketing

You want to connect with customers and prospects as directly as you can, and few marketing efforts have as much impact as an email campaign. That’s because almost everyone has an email address, and it’s likely one of the first things people check every morning.

The first step to email marketing is gathering addresses. Your email list should be a priority. Add a sign-up option on your website, hold raffles at networking events, or organize giveaways on your social media pages in exchange for people’s contact information. When you receive their permission, people in your community are happy to hear from you.

You’ll need to produce a consistent newsletter that’s sent at least once a month. Include news about the insurance industry that may impact customers. Write a blog or produce a short video to share your expertise. Think about what your ideal customer needs to know, and make it engaging to them.

2. Referral program

Remember when people used to ask friends for recommendations while gathered around the water cooler at the office? Although the question is more likely to be posed over Facebook, person-to-person recommendations and referrals are still happening.

So, think about implementing a referral program to encourage your current customers to suggest working with you. Offer discounts to people who recommend you to their friends and family, as well as a discount for new prospects who are considering your services.

You can create a raffle for an incentive prize or give away handy items like water bottles with your company name on them. Again, think about whom you are targeting and create an incentive they’ll appreciate.

3. SEO-friendly website

Every business needs its own website. By using a professional website builder, your site will automatically be mobile-responsive. This means, it will work just as well — and look just as good — on a smartphone or tablet as it does on a desktop computer.

Once you have your website up and running, you’ll want to integrate SEO, or search engine optimization. The reason you want to integrate SEO is simple — online search engines.

Although some people simply ask their friends for advice on insurance agents, most people visit Google or another search engine to find options in their area. SEO helps your site get ranked highly in those search results — organically. And the higher you rank, the better chance you have of being found online. The goal is to show up on the first page of a search because most people don’t scroll any further.

When implementing SEO, along with using the appropriate keywords and common search terms for localized searches, you should also include a variety of online resources to drive traffic to your website. So be sure to include links that direct traffic back to your website in your blog articles, white papers, newsletters, and social media posts. Providing information in a variety of places will allow your prospects to learn from you, which helps them to see you as the expert you are.

4. Online reputation management

While community members used to ask friends and family for recommendations, today they’re just as happy to read and consider reviews from strangers. Online reviews are important tools you can use to your advantage.

The first step is to claim your business online through Google My Business, Yelp, Angie’s List, and any other directory site that your customers use. Then you’ll be able to respond to reviews and encourage your happy customers to add their thoughts.

Reviews are often a source of stress for small and medium-sized business owners, but they don’t have to be. The key is to take control of the message as fast as possible. For positive reviews, write a note of thanks to customers for trusting your company with their business.

For negative reviews, quickly reply with an acknowledgment of the problem. Apologize but never make excuses. Ask the reviewer to contact you directly offline. Use the opportunity as a way to show others your professionalism and customer service, regardless of the circumstances.

5. Paid digital ads

Paid digital ads aren’t quite as easy as calling up the ad rep at the local newspaper and buying space — but it’s also not as hard as many insurance business owners may think. Online ads can be extremely effective for securing new policyholders.

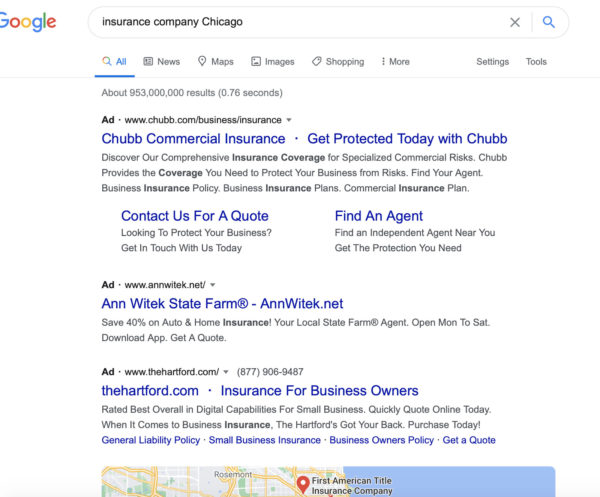

Think about when you search on Google. You may type in “insurance company Chicago” if you are shopping policies. Your business can jump to the top of the search results page by buying a Google ad using those exact keywords. The process is also quite affordable since you pay only when someone clicks on it. That’s known as PPC, or pay per click.

If you decide to place a PPC ad, be sure to review and analyze your back-end metrics. Are some keywords working better than others? If a particular ad isn’t working the way you think it should, you can always retarget your ads. Don’t be afraid to stay dynamic and make changes to your digital marketing plan as you learn more about the behaviors of your target audience.

6. Social media outreach

Of course, everyone is on social media these days. Your business should be as well.

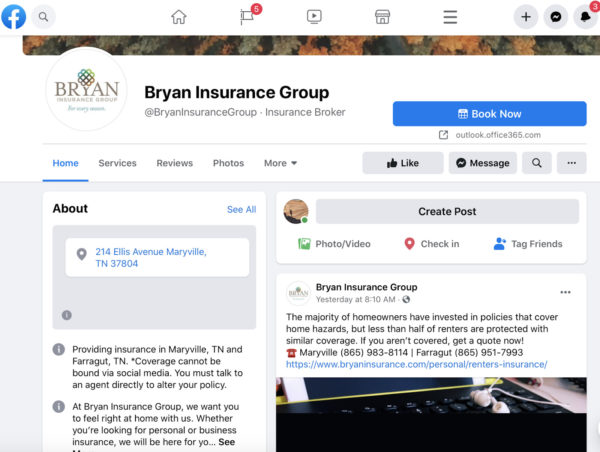

The first step is to create your Facebook business page and fill out the “About Us” section fully. Include a call-to-action (CTA) button on your page to make it easy for people to connect with you. Then stay active by posting your blogs and videos, hosting live webinars, and holding polls so you can learn more about what your target audience is looking for.

You can also create targeted ads through your Facebook business page. Instead of using keywords, like with Google Ads, you can narrow down the people who will see your ad on Facebook by homing in on their geography, demographics, hobbies, and interests. These PPC ads should include engaging images and snappy wording to get noticed.

Want more marketing ideas?

For insurance agents, marketing is a big part of the job. You can learn more ways to capture the attention of new customers and retain your current ones by integrating the best practices in Constant Contact’s free marketing guide, The Download. This free guide is specifically designed for professionals like you to help grow your business fast.