Nearly every financial advisor seeks to maximize their return on investment. Sometimes, the old ways are best.

Email marketing continues to rise to the occasion in the 2020s with up to a 44:1 return on spending. Few other platforms have the same power to reach customers and acquire new leads.

The basics of email marketing for financial advisors examined in this article can get you off to the right start. We look at:

- Why you should use email marketing

- How to acquire leads

- How to onboard prospects

- Tips for conversion

- How to maintain relationships with existing customers

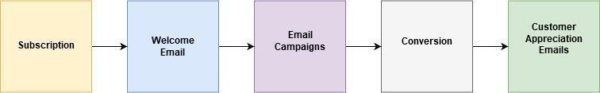

Email campaigns work from the time a customer joins your list to build powerful and lasting business relationships. It’s important to stay in contact throughout the customer lifecycle with newsletters, well-crafted content, and engaging campaigns.

It may seem time-consuming to create so much carefully crafted content. However, offloading work to automated tools lets your campaigns run while you help your customers thrive. There is no reason not to incorporate this potent medium.

Get the expert marketing advice and tools you need to find new financial clients and increase investment from existing ones.

Why you need email marketing

People rely on email today more than ever. Social media sites come and go, but three billion people have an email address. Almost half the world has an inbox. More importantly, they use it regularly.

With so many people online and an open rate of up to 21.2%, you can reach more people than through almost any other medium. The ability for sustained contact makes email campaigns a key building block for continued success.

Email marketing is all about building a relationship with your customers. Don’t just market your services — show your appreciation and offer tips that keep them on the right track for financial success.

Acquiring email leads

Although highly effective, it can be tricky to acquire the subscribers you need for your email lists. Scams and unethical practices surrounding pre-built lists tarnish reputations and result in poor leads.

There are multiple approaches to building an extensive subscription list. Acquire quality leads from:

- Blogs

- A personal website

- Promotions

- Free tutorials

- Referrals

Many of these approaches use your web presence to capture leads. Email lists help but shouldn’t be your primary source.

A correctly built site creates authority, builds credibility, and engenders the trust you need to grow your list. Remember to include blog posts on your site with a call to action leading to a contact page.

Allow leads to opt in

Whatever you use to pique interest, make sure that you let new contacts opt-in to your list and offer something in return for their address. Prospects need to believe you offer something they want.

As a financial advisor you can:

- Enroll leads in a raffle with a catchy prize

- Provide a unique perspective on financial management

- Offer educational materials

- Write and offer a white paper

- Send a promotion in return for signing up

Your lead magnet can build the perception of you as an expert. It can also help improve the chance that a subscriber opens your first email when sent within an hour of joining your list.

Onboarding prospects

Once people subscribe, a welcome series is the perfect way to generate interest. Capitalize on the interest from your lead magnet and start to craft a relationship.

People are more likely to open these messages. In fact, subscribers open about 50% of welcome emails. That makes them 86% more effective than standard newsletters.

A great series of welcome messages includes two emails. The first email should welcome new subscribers, fulfill the offer from your lead magnet, and reiterate what customers can expect in the future. It’s also a good idea to include a short statement thanking them for signing up.

Your second message should include a more direct call to action. Invite subscribers to connect with you through other channels such as social media. This email is the jumping-off point for enrollment in newsletters, events, and updates.

Never pitch directly. These messages pique the interest of future clients and let them know they’re appreciated.

Converting subscribers into customers

Email marketing campaigns act like your website. They build trust and credibility but do so over a longer time period. It takes persistence to convert someone on your email list to a customer. Eventually, if your campaign is effective, interested subscribers will contact you for more information.

There are many types of campaigns to choose from after your welcome series. Try:

- Circulating a financial advisor newsletter based on your customers’ needs

- Occasionally offering prizes that require customers to contact you

- Pushing any articles you publish on a blog or in a journal

Effective emails nudge readers to contact you. They build the credibility and authority required to take the leap to a more direct meeting.

Never directly sell products in emails. Try not to inundate subscribers with emails either. Space the time between messages appropriately to avoid ending up in their spam folders. Instead, aim for a weekly newsletter or offer a monthly raffle, to make sure every email they get from you offers value.

Crafting compelling financial content

Content is the most important part of any email campaign you choose. Compelling content is thoughtful, engaging, concise, and relatable. It also shows people the human side of your business, which is key for building customer trust — after all, a financial relationship is still a relationship.

Advisors like Dave Ramsey built empires by creating more than just a company that helps customers lead a debt-free life or save for retirement. There’s a personal story at the core of Ramsey’s business that people can connect to. He often references his own journey from bankruptcy to financial success.

Along with personal elements, your campaign should include useful tips, engaging insight on relevant trends, and customer success stories. Building credibility through helpful, quality content convinces people that your services are best for them.

Automating your campaign

You don’t have to be a computer whiz to build a successful campaign. Automation software lets you create a series of emails with content based on customers’ interactions and responses. Drip campaigns, which include pre-written sets of messages sent to customers over time, benefit particularly well from automation.

Automation software helps support your email marketing strategy from lead generation to conversion. These tools allow you to respond quickly once someone subscribes, and they’ll continue to work until your lead leaves the list or becomes a customer. Once you launch your campaign, you can get right back to focusing on the day-to-day operations of your business.

Get started with Constant Contact

Email marketing for financial advisors offers quality leads at low expense. With the right content, email lets you build credibility and turn leads into customers. Marketing platforms can help if you’re not well versed in crafting content or deciding on the right campaign for your services.

Constant Contact provides extensive financial email marketing assistance through many online tools. Check out The Download, our complete guide to marketing for professional services, to learn how we help customers achieve the most from every campaign.