Content marketing can be a powerful method for attracting insurance leads and producing conversions. Blog content, in particular, allows you to connect with current and prospective clients while improving search engine rankings. Finding ideas for new and engaging insurance blog posts can be difficult, however.

Many website visitors find insurance-related content inherently dry or confusing, so it takes a little extra effort to keep them engaged. This presents both a considerable challenge and an opportunity. Outshine the competition with quality blog content, and you’ll have no trouble attracting — and retaining — clients.

For inspiration, we’ve highlighted nine of the best insurance blog topics to keep your website feeling fresh. A few ideas include:

- 1. Explain available types of insurance

- 2. Insight into local insurance requirements

- 3. Infographics and other visual content

- 4. Q&A features

- 5. Interview or otherwise highlight noteworthy clients

- 6. Interview insurance representatives

- 7. Guest blog posts

- 8. Seasonal blog posts

- 9. Humorous blog posts

- Discover the most effective tactics for insurance marketing

Find more leads and drive policy renewals with expert marketing advice and all the tools you need, all in one place.

Feel free to adapt these to better fit your agency, your insurance marketing objectives, and your desired audience.

1. Explain available types of insurance

The ideal insurance website will position your agency as an authority. Clients should feel confident that they can turn to you for answers.

Begin with simple yet comprehensive overviews of the various types of insurance you provide, as well as factors that clients should keep in mind as they choose between top kinds of coverage.

Because the topic of insurance is so broad — and because your agency likely provides a wide range of options — it’s worth your while to split this type of content into a series of posts. Each should delve into the many types of insurance provided for that category.

For example, a blog feature on life insurance may begin by differentiating term and whole life insurance before delving into specifics such as guaranteed whole life or indeterminate premium whole life.

2. Insight into local insurance requirements

Insurance requirements vary dramatically from one state to the next. This makes the already complicated selection process feel that much more overwhelming to insurance leads. Address your potential customers’ concerns with locally targeted blog content that delves into state or regional requirements.

This type of content can include both evergreen features detailing a particular region’s general approach and time-sensitive updates about recent developments that might impact clients. For example, in the immediate aftermath of new legislation about car insurance requirements, your blog should feature a detailed update explaining these laws and how they might impact local drivers.

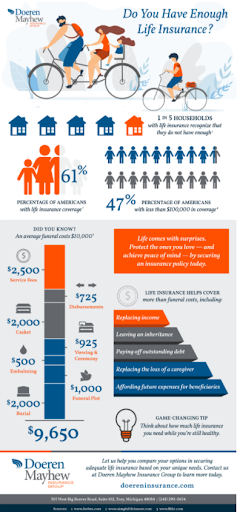

3. Infographics and other visual content

Infographics make it easier for blog visitors to comprehend important insurance data that they might otherwise find confusing or challenging to navigate. These appealing visuals can be integrated into existing blogs or used as the basis of entire posts.

Concepts effectively illustrated by blog-based infographics include:

- Definitions for confusing insurance terms

- Comparisons between premiums and deductibles for different types of insurance

- Factors that might influence insurance rates for different types of clients

- Results from surveys about clients’ insurance preferences and existing coverage

- Data about common types of car accidents in your state

4. Q&A features

In-depth content is vital to establishing your company as a respected resource within the insurance industry. Sometimes, however, readers prefer concise, to-the-point blog posts.

Keep it simple by providing easy-to-understand answers to the questions your representatives most frequently receive. These should provide basic insight while also encouraging readers to get in touch to learn more.

While this type of blog post can take the form of a single-page FAQ, you’ll discover a wealth of content by posing each question as a new update in an ongoing series. Each query should be followed by a basic explanation, clear definitions, and, if needed, supporting data.

Feel free to include these common questions:

- When should I update my life insurance coverage?

- Under what circumstances should I file an auto insurance claim?

- How do umbrella insurance policies work?

- Should I bundle my auto and homeowners insurance?

- Will my credit history influence my insurance rates?

- What are the differences between actual cash value and replacement costs?

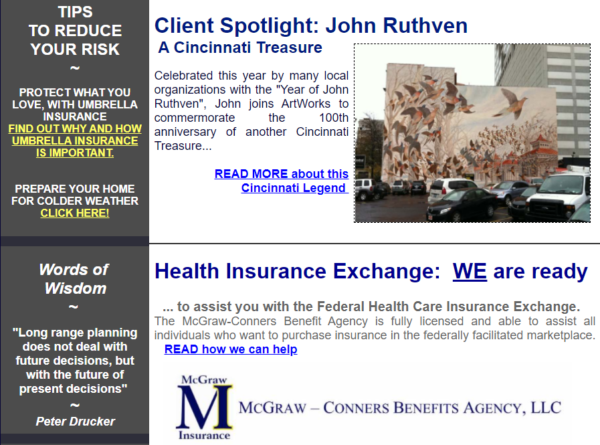

5. Interview or otherwise highlight noteworthy clients

Sometimes, the best insights into insurance value come from other businesses or individuals that maintain policies. These clients may credit your insurance agency with giving them the confidence to pursue everything from homeownership to ambitious entrepreneurial projects. By interviewing them, you can provide a detailed glimpse at the impact your policies have on real people.

Interviews also represent an excellent opportunity for making your client base feel more like a community. This is a difficult objective to accomplish in the insurance industry. After all, clients tend to forget about your impact on their lives when they aren’t actively selecting or cashing in on policies. Interviews remind them that they’re part of a diverse but connected community that includes several inspiring figures.

The specific questions included in each interview will vary based on the person or business featured. At a minimum, aim to capture what motivated the interviewee to seek policies from your agency — and how this coverage has made it easier for them to pursue and achieve lofty goals. Even if you don’t include a full interview, simply shining a spotlight on a noteworthy client will demonstrate that your services are trusted throughout your community.

6. Interview insurance representatives

Clients shouldn’t view insurance representatives as a means to an end. Let them learn more about the hardworking individuals responsible for your company’s success. Just as client interviews bring a human element to your agency, pieces dedicated to your most inspiring representatives can demonstrate the empathy and passion they bring to every consultation.

Your interview can take many angles, from personal anecdotes to deep inquiries on the philosophical elements of insurance coverage. In general, it should capture the essence of what makes each rep unique while still maintaining your company’s general branding and voice. Examples of topics or questions worth featuring include:

- Details about the representative’s background. Why did this person choose the insurance industry? Should readers know about any degrees or previous jobs?

- Awards or other accomplishments. These could include industry accolades or proud moments from different areas of life.

- Information about volunteerism or charitable pursuits. How is the representative in question involved in the local community?

- Key professional philosophies or sources of inspiration. What motivates the featured rep? Which convictions underscore this person’s work? Highlight how core beliefs make the interviewee a great advocate for insurance clients.

Don’t forget to include visually rich content, such as photos and videos. Go beyond the professional headshot to add images of featured representatives pursuing their hobbies away from the office. Whether you’re sharing pictures of vacations or athletic pursuits, these graphics will make your reps more relatable.

7. Guest blog posts

Whether written by representatives, clients, or organizations with which you’re aligned, guest posts shake things up by bringing a new perspective to your blog. They’re also great for marketing, as writers can promote guest content on their social media pages or in email newsletters.

When possible, get experts involved with your blog to share their thoughts on the value of various types of insurance. Tailor these posts based on the types of insurance you provide and the specific policyholders who might find certain guests compelling. For example, a company that offers pet insurance can seek input from a veterinarian or a breeder. Homeowners insurance providers may benefit more from guest posts written by real estate agents or home inspectors.

8. Seasonal blog posts

Top insurance blog ideas tend to involve evergreen content, but seasonal updates can play an important role in getting readers invested. These can be directly tied to the process of obtaining coverage, especially if it relates somehow to the holidays or other seasonal events. Examples include:

- Information on whether — and to what extent — renters or homeowners insurance covers Christmas gifts

- Guidance to help readers determine if they should invest in insurance for gifts

- An insurance expert’s perspective about the best times of the year to invest in specific types of coverage

- Tips for avoiding car accidents and accompanying increases in insurance rates during the winter

- Insight into the relationship between spring cleaning and various insurance policies

9. Humorous blog posts

Add a little personality to your blog with humorous content that reflects your agency’s culture. This strategy can pay dividends if you’re eager to establish a more personable feel. This can be riskier than authority-building content, but it also holds the greatest potential to build long-term engagement.

Be sure to tailor your humor to reflect your core audience. What works for a family-oriented homeowners insurance provider might not be ideal for a company that focuses on risk-takers or athletic types.

Blog options to get readers laughing include:

- Strangest types of insurance. Highlight unusual coverage, such as mustache insurance. In addition to prompting a chuckle or two, this blog will remind clients that their unique insurance requests may not be as unattainable as they think.

- Insurance jokes or quotes. Poke fun at yourself with a few lighthearted quips that show the lovable absurdities of the insurance industry. Tread carefully, taking care to keep jokes positive and endearing.

- Blogs from unique perspectives. Write a post from the viewpoint of a dog or cat covered by pet insurance or a baby covered by health or life insurance.

Discover the most effective tactics for insurance marketing

Would you like more ideas for building your insurance blog topics or otherwise developing a marketing strategy? Check out Constant Contact’s The Download. This resource will help you make sense of digital marketing so you can score new clients and enjoy repeat business.