Today’s consumers expect reputable businesses to have a website.

Consumers are looking online for products and services more frequently and doing more online research before making buying decisions. While most online shopping centers on retail, customers are increasingly purchasing services like insurance policies online as well.

Before we introduce you to our insurance website builder, let’s take a look at why insurance businesses should create a website and the essential elements you’ll want to include.

Why you should create a website for your insurance business

The most important reason to build an insurance website is straightforward. The majority of your new customers will likely originate online. Consider this statistic — 9 in 10 new life insurance sales are driven to some degree by digital interaction, including websites. No doubt this trend applies to other insurance lines as well.

Beyond meeting customer expectations, there are a few other key reasons you should consider building a website to help with marketing for your insurance business.

Referrals

It’s a sure sign that you’re doing something right when your clients want to refer their friends, coworkers, and family to you. This is much easier when you have a website. Your contact information and details about your services are all in one, easy-to-find place.

When these referrals reach out to you, they will be more educated about your products ahead of their call or email.

Credibility

We know that customers expect reputable companies to have a website, and here’s why — it boosts their credibility. According to many reputable surveys, consumers overwhelmingly feel that small businesses with websites are more credible than businesses without websites.

When you put yourself in the shoes of a potential customer, this preference will likely come as no surprise. Companies that take the time to create an informative, welcoming website seem more trustworthy.

Advertising

Digital advertising is a must for almost any small business. Unlike print ads, you can target a specific audience and keywords on social media channels like LinkedIn and Facebook, the top social channels for insurance businesses.

These paid ads can link customers to your website where they can get a quote or learn more about your services.

Lead capturing

Your website can open new opportunities for capturing leads. You can invite email newsletter subscribers, collect information with a quote tool, and provide simple ways for potential customers to get in touch.

The importance of making your website mobile-responsive

About half of all web traffic today originates on mobile devices — usually smartphones. It’s crucial to create a website that works well on these smaller screens. When a website is not optimized for mobile device viewing, customers will have a much more challenging time using your site. Many will simply give up.

Perhaps most importantly, Google prefers mobile-responsive sites, ranking them higher than sites that have not been optimized. If you’re not sure if your site is considered mobile-friendly by Google, you can test it.

Mobile optimization is built into modern insurance website builder tools. These tools allow you to see what the site will look like on a mobile screen so you can make sure customers will be able to find what they need.

What to include on your insurance website

Insurance business websites are similar to other business sites. Your page should tell customers who you are, what you do, and how to contact you. You’ll also want to work toward creating a space that feels as engaging and welcoming as your physical office.

Let’s take a look at the must-have elements for your insurance business website.

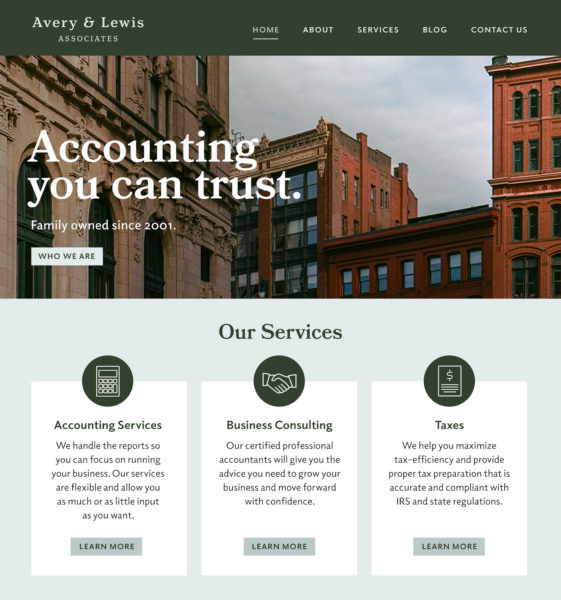

Homepage

Your homepage is like a storefront in many ways. Imagine walking down a busy street and window shopping. Are you more likely to go inside stores with a friendly, professional presence or stores that seem to be winging it? Most likely, you’d pick the one that feels more professional.

The same is true of websites. If someone pulls up your website through a search or a direct link and finds a barebones, generic-feeling homepage, they won’t be as likely to feel enticed to dive in and learn more.

It’s important to strike a balance here. Yes, your homepage should be compelling, and most of all, authentically you. However, don’t feel you need to include a lot of bells and whistles. Use automated features sparingly. A video that starts playing when the page is accessed, for example, can be part of your sales and marketing strategy, but it could slow down how fast the page loads. This can also affect your search rankings.

Services page

Your homepage should link directly to your product and service offerings. This page describes the policies and related products you provide. It should be clear which insurance lines you can handle.

The essential purpose of this page is to explain how you can solve a visitor’s problem or lessen their worries. It might be the peace of mind a life insurance policy can offer or helping a business meet an industry requirement for insurance coverage.

Your Services page is a good place to offer some customer education in line with what you’d discuss in person with a prospective client. Briefly explain the insurance coverage you can provide, and give real-life examples of why someone might need the coverage.

Be sure to include some images, and do some search engine optimization (SEO) keyword research to find the most popular related phrases. Include these within your content. When you create a blog, you can link to blog posts related to the information you provide on this page.

Quote page

If your website will include a tool visitors can use to get a quote on a policy, be sure to link to it from every page. The visitors who fill in the quote request form represent viable leads.

Getting a quote is also likely to be why a visitor opened your site in the first place. Don’t make it difficult to find out where they can get one.

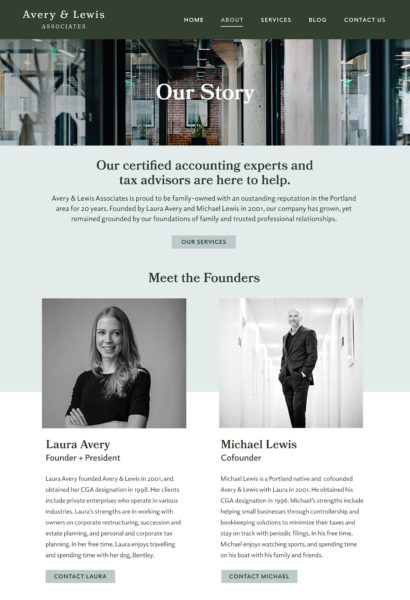

About page

Your About page allows you to connect with visitors on a more personal level. You can stick with your professional qualifications and accomplishments, write a personal bio, or offer a bit of both. The content on your About page should reflect the perception you want people to have of you and your business.

Tell the story of you. When did you become an insurance agent? What do you like about your profession? What do you do for fun (if you want to include personal details)?

Including a headshot or a family photo can add a friendly, personal touch. If you can capture some of your personality in the picture, that’s even better. Are you a dog lover or a scuba diver? Consider including a related image or two.

Blog

One way to get into Google’s good graces is by creating and maintaining a blog on your website. Having subpages helps your business get discovered by search engines, and each blog post does, as well. An active blog adds to your brand authority, a trait Google highly values.

When you write posts that reflect your expertise, you build trust.

Write blog posts on various topics. For example:

- Industry news

- Advice about choosing the right policy

- Personal updates if it fits your brand voice (“I got married!”)

- Professional updates (“I’m attending a conference about…”)

Contact page

An easy-to-find Contact page is crucial for any insurance business website. It’s the starting point for many visitors who eventually become clients. Remember, not every potential lead will fill out your Quote page. When someone wants to discuss options before getting a quote, make it easy for them.

You can include a web form to collect direct comments or embed a link that will allow visitors to email with one click or tap.

Keep your Contact page streamlined, and link to it at the bottom or top of each page.

Ready to get started?

Now that you understand why it’s essential to create a website for your insurance business and what you should include, it’s time to find a website-building platform. Start by checking out this year’s best website builders.